Discrete & Manufacturing

Discrete, Manufacturing, Engineering, High Tech and Semiconductor Industries

Our technology industry practice covers the following industries:

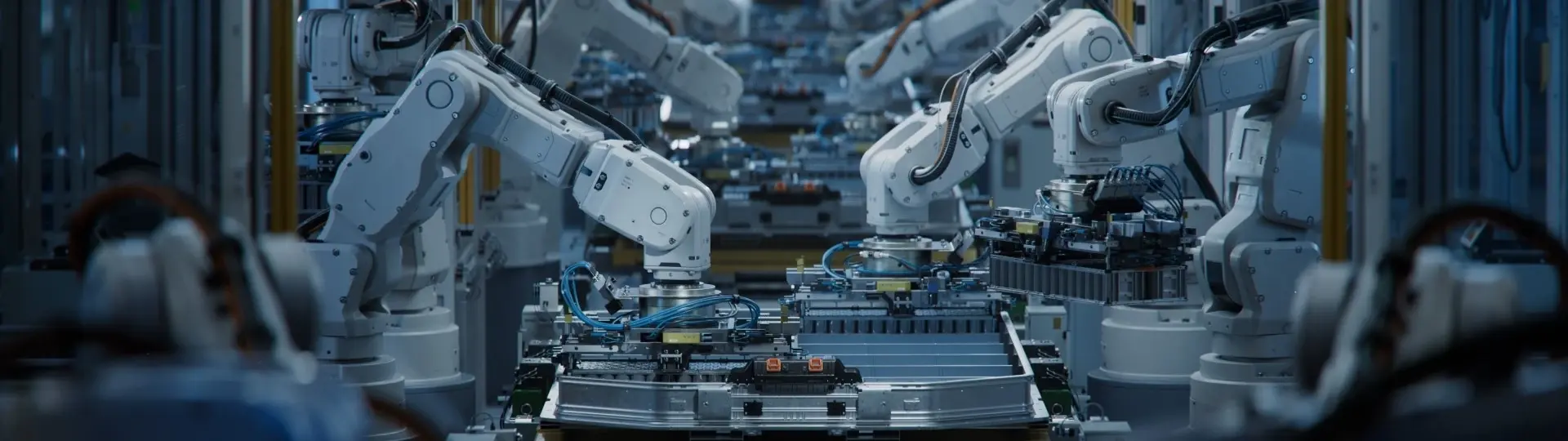

Mechanical engineering, electrical engineering, electronics, precision instruments, watchmaking, medical technology (medtech), construction and building.

The transformation of organizations and the accompanying digitalization and automation of processes present significant challenges for manufacturing companies.

_1.webp?width=500&height=326&name=Maschinenbau%20%26%20Fertigungsindustrie%20(Module)_1.webp)

At Wirz & Partners, we have a dedicated team of industry experts in executive search, to support the top player of the European tech industry, for their board an c-suite searches.

The corporate landscape has evolved to such an extent that adapting to new technologies and developing new ways of working are essential. Recognizing and capitalizing on opportunities requires leaders with both technological expertise and a vision to leverage new technologies for competitive advantage and strategic goals.

We are your executive search partner for growth, transformation, pre and post M&A.

With our extensive industry and market knowledge as the leading headhunter in this field, we support you in finding the right profiles.

We provide comprehensive advice, to investors, shareholders, the board and the Top Management, in the discussion and definition of future strategically important key positions at the C level and in top management, ensuring you have the right leaders to meet tomorrow’s demands.

- Many Swiss and EMEA tech companies lack established methods for measuring innovation success.

- Major barriers to high ROI include challenges in controlling and measuring innovation processes.

- Successful innovations depend on strategic management and tailored measurement approaches.

To cope with the mentioned challenges, top Swiss & EMEA industry companies employ the following strategies:

Supply Chain Issues

Diversification of Suppliers: Reducing dependency on single suppliers.

Inventory Management: Implementing advanced inventory systems to buffer against disruptions.

Local Sourcing: Increasing local procurement to minimize risks from global disruptions.

Rising Energy Prices

Energy Efficiency: Investing in energy-efficient technologies and practices.

Renewable Energy: Increasing use of renewable energy sources to stabilize costs.

Slow Economic Growth in EMEA

Market Diversification: Expanding into new markets beyond EMEA.

Innovation: Focusing on innovative products to capture market share.

Automotive Industry Transition to EV

R&D Investment: Investing in R&D to develop components for EVs.Partnerships: Forming strategic partnerships with EV manufacturers.

Higher Refinancing Costs

Financial Management: Refinancing at favorable rates when possible and improving cash flow management.

Cost Control: Implementing stringent cost control measures.

Strong Swiss Franc

Cost Efficiency: Improving operational efficiency to offset higher costs.

Value-Added Products: Focusing on high-value, premium products that justify higher prices.

The primary investment strategies for the Swiss and EMEA tech industry in 2025 and 2026 revolve around several key areas aimed at ensuring growth, innovation, and resilience amidst ongoing global challenges.

Digital Transformation and Innovation

Cloud Computing: Continued investment in cloud infrastructure to enhance scalability, flexibility, and cost-efficiency.

Artificial Intelligence (AI): Focus on generative AI and applied AI to drive efficiency, productivity, and new business opportunities. AI-related investments are expected to see significant growth, potentially reaching $200 billion globally by 2025 (Deloitte United States) (McKinsey & Company).

Cybersecurity: Enhancing security frameworks to protect against evolving threats, especially with the rise of remote work and increased digital interactions.

Supply Chain Resilience

Diversification of Supply Chains: Building more resilient supply chains by diversifying suppliers and geographic locations to reduce dependency on single sources and mitigate risks from global disruptions (Deloitte United States).

Technological Integration: Utilizing technology to improve supply chain transparency and efficiency, ensuring better risk management and response capabilities.

Economic Adaptation

Market Expansion: Exploring new markets and adapting product offerings to align with the shifting economic landscape and consumer demands, particularly in regions experiencing slower economic growth.

Cost Management: Strategic cost management, including optimizing operations and reducing tech debt, to maintain financial flexibility amidst higher refinancing costs and economic uncertainties.

Talent and Workforce Development

Skill Development: Investing in workforce development to build expertise in high-demand areas such as AI, cybersecurity, and cloud technologies.

Automation and Efficiency: Leveraging robotic process automation (RPA) and other automation technologies to streamline operations and reduce labor costs.

These strategies are designed to help Swiss tech companies navigate the challenges posed by supply chain disruptions, rising energy prices, slow economic growth in EMEA, and other economic pressures, ensuring they remain competitive and resilient in the global market

For machinery and industrial technology companies in Switzerland, the rise of Industry 4.0 and the Internet of Things presents both transformative opportunities and ongoing challenges. Key trends such as the push towards automation, the need for sustainable practices, and the drive for digital integration are reshaping the landscape. However, many organizations are still grappling with the complexities of digital transformation. Adapting to an interconnected world requires more than adopting new technology; it demands innovative business models, advanced talent, and organizational cultures dedicated to continuous improvement and resilience.

In the high-tech and semiconductor industries, Swiss companies face specific challenges, including the rapid pace of technological advancements, supply chain disruptions, and the imperative for cybersecurity. Additionally, the increasing need for data analytics and the integration of artificial intelligence further complicate the landscape.

Wirz & Partners’ Machinery and Industrial Technology Practice is dedicated to addressing these challenges. We work closely with boards, CEOs, and senior leaders to identify and develop the most effective talent solutions.

Our expertise ensures that we can source the external talent required in this dynamic environment or assist in nurturing internal capabilities. Our approach is focused on one goal: helping you uncover and cultivate the finest leaders to navigate and excel in the evolving industry landscape.